Green Energy

- Clp Set To Buy Suzlon's Rs 800 Crore Telengana Project For India Solar Debut

Hong Kong’s CLP Group, the largest overseas investor in power in India, wants a piece of the country’s solar energy action. CLP (formerly China Light & Power), is finalising its solar debut through an acquisition. It’s local arm is in advanced...

- Renesola, Pristine Sun To Form Jv For 300mw Solar Projects In Us

Article published on http://solar.cleantechnology-business-review.com/ , in august the 6th, 2015 China's ReneSola and San Francisco-based Pristine Sun have agreed to form a joint venture (JV) to develop, build and operate more than 300MW...

- Pv In Brazil: 382 Projects Accredited For Auction On August 14th

article orginally published on www.solarserver.com, in June 4th, 2015 Solar PV rooftop system at a football stadium in BrazilBrazil’s Energy Research Company (EPE), which is conducting the nation’s Reserve Energy Auctions, on June 1st, 2015 announced...

- Brazilian State Minas Gerais To Invest $324 Million In Solar Pv Projects

Article originally published in www.cleantechnica.com, on May 11th 2015Minas Gerais, the south-eastern state of Brazil, has announced that it will start auctions of solar photovoltaic power plants later this year.The state government recently announced that...

- How France Is Helping India Meet Its 100 Gw Solar Target

Article published in cleantechnica.com, on april 14th, 2015.During Modi’s recent visit to Paris, India and France signed a memorandum of understanding to expand cooperation in the fields of solar and other renewable energies.The memorandum was...

Green Energy

The Indian market offers large scale PV projects; rapid ramp up of solar power has put India on the global solar stage

Article published Wednesday 30th of May at www.solarserver.com

The feed-in-tariff (FiT) market in India is governed by various national and state policies. Solar installations prompted by project allocations under the National Solar Mission (NSM) and the Gujarat Solar Policy have driven India's installed solar PV capacity from 22MW in January 2011 to 974.56MW in May 2012. This rapid ramp up of solar power has put India on the global solar stage.

In Solar Server' May 2012 Solar Report guest author Mohit Anand, Senior Consultant at BRIDGE TO INDIA, closely examines market developments and opportunities.

285 MW recently allocated in Karnataka, Orissa, and Madhya Pradesh

The NSM allocates projects under a competitive, reverse bidding mechanism to arrive at the lowest possible tariffs for its projects. All state policies, except Gujarat, follow a reverse bidding mechanism similar to the NSM. Gujarat allocates projects for a fixed FiT based on a technical and financial assessment of the project developers by a government committee. Projects have recently been allocated by the Indian states of Karnataka (60MW solar PV allocated), Orissa (25MW solar PV allocated) and Madhya Pradesh (200MW solar PV allocated).

- PV plant in the state of Gujarat. Gujarat represents roughly 2/3 of the nation's installed PV and CSP capacity.

- On April 23rd, 2012 officials inaugurated a 1 MW canal-based solar photovoltaic (PV) plant

400MW is upcoming in Rajasthan

Another state that is in the process of allocating projects is the western Indian state of Rajasthan. Rajasthan is also poised to be a leader in installed capacity in the future as it has been the preferred location for projects under the NSM. Out of the 485MW of solar PV capacity with signed Power Purchase Agreements (PPAs) under phase one of the NSM, 400MW is upcoming in Rajasthan.

Market factors support larger projects

Under the reverse bidding mechanism, projects are allocated to developers offering the maximum discount to a benchmark tariff set by the government regulatory authority. The allocation process in India is highly competitive and the capacity being sought by project developers is much higher than the capacity that is allocated. As an example, for an allocation of 350MW under batch two of phase one of the NSM, bids totaling 1,905MW were received. Due to the excessive competition, reverse bidding brings down the tariff significantly. The tariffs in India have been pushed to as low as INR7/kWh (EUR 0.10/kWh) for allocations in the state of Odisha (formerly known as Orissa). Lower tariffs cut the margins for the developers and may make the projects financially unviable. This becomes more severe if the size of the projects is small. The only choice developers have is to develop larger projects so that they can bring down the effective cost per megawatt installed.

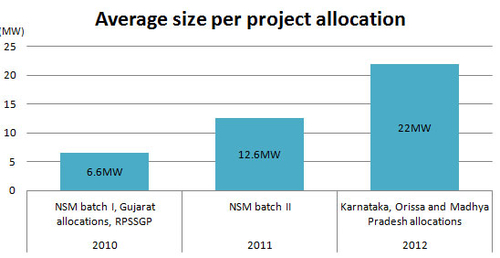

- The average size of Indian PV projects nearly tripled since 2010

Inexperienced developers underestimating risks and challenges

Many inexperienced developers with no long term interest in solar power generation have entered the market opportunistically. Such developers are looking to take advantage of the accelerated depreciation and income tax benefits being offered by the government for solar projects. Most of these developers lack the experience of developing solar projects and, as a result, underestimate the associated risks and challenges. They prefer small projects as it allows them to limit their risks while being aggressive with their bids. As a result, they compete to get small capacities at tariffs that are financially unviable.

Many of these developers have not been able to achieve financial closure and have paid hefty penalties due to project delays. This has led the policy makers to increase the project sizes offered (Ref: Figure 1). For example, for batch two of phase one of the NSM, the capacity per project was increased to 20MW from the previous 5MW in batch one, and each developer could obtain a maximum of 50MW of solar PV capacity as opposed to only 5MW possible in the first batch. Further, the state of Odisha has allocated five projects of 5MW each with the lowest bidder having an option to obtain the entire 25MW, while the state of Madhya Pradesh has placed no limit on the size of projects that it has allocated.

Bids for a particular tariff are based on speculations on component prices

In terms of execution, the time period between offering the tariff discount and buying the components for the plant is as large as six to ten months. As a result, a large part of the decision to bid for a particular tariff is based on speculations on component prices. The speculation needs to take into account the expected future module prices. This creates significant uncertainty for the developer. Typically, a developer with a large project is able to assume a benchmark cost for the modules and other components for the project calculations at the time of bidding. Then, because of having a large capacity in hand, the developer is able to leverage the project size to successfully procure components at the initially assumed benchmark costs from the suppliers. Smaller projects would be unable to mitigate the speculation risk in a similar manner.

- Partial view of the Gujarat Solar Park scheduled on completion with 600 MW.

- Dr. Farooq Abdullah, Union Minister for New & Renewable Energy: The National Solar Mission contributes to India's long term energy security as well as its ecological security

Indian banks are reaching their cap on lending

Project financing is a key challenge for the project development community in India. On the cost side, interest rates in India are as high as 13-14% and reduce the margins significantly in a competitive environment. Moreover, Indian banks have been hesitant in lending to solar project developers. The primary reason is that solar lending in India is a part of the power sector, and the banks are reaching their cap on lending to it. As a result, many projects have been delayed and even cancelled as they have been unable to secure financial closure. This has prompted project developers to try and secure international financing for their projects. The effective interest rate for international financing with currency hedging is 200-300 basis points lower than Indian interest rates. International funding sources that have been lending to Indian solar project developers include the US Export Import Bank (EXIM), KfW Bankengruppe (Germany), Asian Development Bank (ADB) and the Overseas Private Investment Corporation (OPIC) among others. However, most international financiers are only willing to fund projects larger projects that are a minimum of 10MW. This is because smaller projects do not justify the associated transaction costs for such banks.

Larger projects are here to stay

In the first leg of project allocations in India (NSM batch one of phase one and the Gujarat Solar Policy) inexperienced and non-strategic developers received around 56% of the project allocation share. Their share in recent allocations (NSM batch two of phase one and state allocations in Madhya Pradesh, Karnataka and Odisha) has gone down to 24%. These developers will not have a significant share of reverse bidding based FiT projects in the long run and the market will be dominated by larger, more experienced developers.

Most large project development opportunities in mature solar markets are drying out. Even most new markets like Japan, South America and the Balkans region are focusing on distributed generation. India is one of the very few countries suited for larger projects. This makes India an ideal investment opportunity for investors and project developers looking for projects with scale.

Find more about our products at :

www.ciel-et-terre.net/floating-solar-system/

http://ciel-et-terre.net/rooftop-solar-system/ http://ciel-et-terre.net/ground-solar-system/

- Clp Set To Buy Suzlon's Rs 800 Crore Telengana Project For India Solar Debut

Hong Kong’s CLP Group, the largest overseas investor in power in India, wants a piece of the country’s solar energy action. CLP (formerly China Light & Power), is finalising its solar debut through an acquisition. It’s local arm is in advanced...

- Renesola, Pristine Sun To Form Jv For 300mw Solar Projects In Us

Article published on http://solar.cleantechnology-business-review.com/ , in august the 6th, 2015 China's ReneSola and San Francisco-based Pristine Sun have agreed to form a joint venture (JV) to develop, build and operate more than 300MW...

- Pv In Brazil: 382 Projects Accredited For Auction On August 14th

article orginally published on www.solarserver.com, in June 4th, 2015 Solar PV rooftop system at a football stadium in BrazilBrazil’s Energy Research Company (EPE), which is conducting the nation’s Reserve Energy Auctions, on June 1st, 2015 announced...

- Brazilian State Minas Gerais To Invest $324 Million In Solar Pv Projects

Article originally published in www.cleantechnica.com, on May 11th 2015Minas Gerais, the south-eastern state of Brazil, has announced that it will start auctions of solar photovoltaic power plants later this year.The state government recently announced that...

- How France Is Helping India Meet Its 100 Gw Solar Target

Article published in cleantechnica.com, on april 14th, 2015.During Modi’s recent visit to Paris, India and France signed a memorandum of understanding to expand cooperation in the fields of solar and other renewable energies.The memorandum was...