Zero Hedge:

Latest Congressional Budget Outlook For 2012-2022 Released, Says Real Unemployment Rate Is 10%

Submitted by Tyler Durden on 01/31/2012

What do the NAR, Consumer Confidence and CBO forecasts have in common? If you said, "they are all completely worthless" you are absolutely correct. Alas, the market needs to "trade" off numbers, which is why the just released CBO numbers apparently are important... And the fact that the CBO predicted negative $2.5 trillion in net debt by 2011 back in 2011 is largely ignored. Anyway, here are some of the highlights.

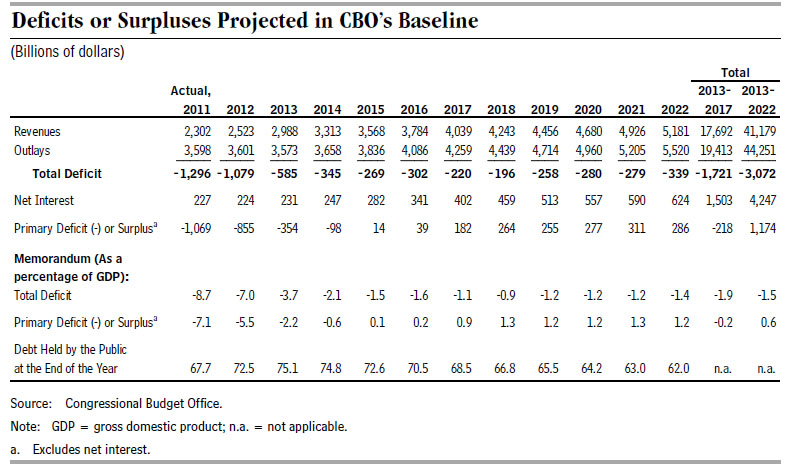

- 2012 Deficit: $1.1 trillion; 2013 Deficit: $0.6 - yes, we are cackling like mad too...

- Unemployment to remain above 8% in 2012 and 2013; will be around 7% by end of 2015; to drop to 5.25% by end of 2022.

- This forecast is utterly idiotic and is completely unattainable unless the US workforce drops to all time lows and the US economy generates 300,000 jobs a month for 10 years

- Needless to say, CBO assumes the best of all worlds in this meaningless forecast

- But here is the kicker: "Had that portion of the decline in the labor force participation rate since 2007 that is attributable to neither the aging of the baby boomers nor the downturn in the business cycle (on the basis of the experience in previous downturns) not occurred, the unemployment rate in the fourth quarter of 2011 would have been about 1¼ percentage points higher than the actual rate of 8.7 percent" translation: CBO just admitted that the BLS numbers are bogus and real unemployment is 10%. Thank you

Here is the CBO's alternative forecast which is a little closer to reality:

CBO has developed budget projections under an “alternative fiscal scenario,” assuming—instead of current law—that certain tax provisions that have recently expired or are set to expire (including most of the provisions in the 2010 tax act but excluding the Social Security payroll tax reduction) are instead extended, that the AMT is indexed for inflation after 2011 (starting from the 2011 exemption amount), that Medicare’s payment rates for physicians’ services are held constant, and that the automatic enforcement procedures of the Budget Control Act do not take effect. Under this scenario, deficits from 2013 through 2022 would average 5.4 percent of GDP, compared with the 1.5 percent in the baseline.

Some view on SSN and Medicare:

- At $1.6 trillion in 2012, federal outlays for Social Security, Medicare, Medicaid, and other health care programs will make up more than 70 percent of mandatory spending (or 10.4 percent of GDP). Spending for those programs will rise by $1.5 trillion from 2012 to 2022— accounting for nearly all of the growth in mandatory spending over that period. By 2022, spending for those programs will represent more than 80 percent of mandatory spending and 12.8 percent of GDP.

- CBO estimates that, under current law, outlays for Social Security will total $770 billion in 2012, or 5.0 percent of GDP. Over the next decade, spending for Social Security benefits will climb steadily (by an average of about 6 percent per year) as the nation’s elderly population grows and as average benefits rise. By 2022, CBO estimates, Social Security outlays will total $1.3 trillion, or about 5.5 percent of GDP.

- At $856 billion, gross outlays for Medicare, Medicaid, and other mandatory federal programs related to health care accounted for just under 40 percent of mandatory spending (not including offsetting receipts) in 2011.6 CBO estimates that outlays for those programs will dip to$847 billion in 2012, or 5.5 percent of GDP, reflecting a decline in Medicaid spending. In CBO’s baseline projections, spending for health programs more than doubles between 2012 and 2022, rising by an average of nearly 8 percent per year and reaching $1.8 trillion in 2022. That spending is expected to represent 7.3 percent of GDP in 2022, an increase of nearly 2 percentage points from its share this year.

And some thoughts from the excel goal seek geniuses in DC on the collapse of the US welfare state:

Because of the aging of the population and rising costs for health care, the set of budget policies that were in effect in the past cannot be maintained in the future. In CBO’s projections for 2022 under the alternative fiscal scenario, gross outlays for all federal programs apart from Social Security, the major health care programs, and net interest are projected to be 7.8 percent of GDP, lower than in any year during the past 40 years and well below the 11.4 percent of GDP that such outlays have averaged over that period. Yet the budget deficit in 2022 under that scenario is projected to be 6.1 percent of GDP. Therefore, to keep deficits and debt from causing substantial harm to the economy, policymakers will need to allow federal revenues to increase to a much higher percentage of GDP than the average over the past 40 years, make major changes to Social Security and federal health care programs, or pursue some combination of the two approaches.

So, if everything that is set to happen, happens, there will be "substantial harm" to the economy, and the CBO just happily assumes all these things will be fixed just in time? Brilliant.

But probably the most imporant part is the CBO's discussion on the labor force participation, and the general unemployment rate:

Participation in the Labor Force. The unemployment rate would be even higher than it is now had participation in the labor force not declined as much as it has over the past few years. The rate of participation in the labor force fell from 66 percent in 2007 to an average of 64 percent in the second half of 2011, an unusually large decline over so short a time. About a third of that decline reflects factors other than the downturn, such as the aging of the baby-boom generation. But even with those factors removed, the estimated decline in that rate during the past four years is larger than has been typical of past downturns, even after accounting for the greater severity of this downturn. Had that portion of the decline in the labor force participation rate since 2007 that is attributable to neither the aging of the baby boomers nor the downturn in the business cycle (on the basis of the experience in previous downturns) not occurred, the unemployment rate in the fourth quarter of 2011 would have been about 1¼ percentage points higher than the actual rate of 8.7 percent. By CBO’s estimates, the rate of labor force participation will fall to slightly above 63 percent by 2017. The dampening effects of the increase in tax rates in 2013 scheduled under current law and additional retirements by baby boomers are projected to more than offset the strengthening effects of growing demand for labor as the economy recovers further.

Don't waste time reading this: none of what is predicted will actually happen. But at 165 pages it makes a good paperweight.

CBO Outlook 2012

- No Depression...

CNS News: Record 94,708,000 Americans Not in Labor Force; Participation Rate Drops in May (CNSNews.com) - A record 94,708,000 Americans were not in the labor force in May -- 664,000 more than in April -- and the labor force participation rate dropped...

- Black Labor Force Participation Rate Under Obama Hits Rock Bottom – Lowest Level Ever Recorded

"You've Been Hoodwinked, Bamboozled" From Gateway: Five years in to Barack Obama’s presidency, the number of African-Americans participating in the labor force has hit rock bottom.The news media has ignored this stunning revelation from Friday’s...

- "how Would You Feel If You Knew That Almost All Of The Money You Pay In Personal Income Tax Went To Pay Just One Bill, The Interest On The Debt?”

CNBC TodayChances are, you and millions of Americans would find that completely unacceptable and indeed they should.But that is where we may be heading.Thanks to the Fed, the interest rate paid on our national debt is at an historic low of 2.4 percent,...

- For Discussion: Deficit Reduction

HERE in the Washington Post you can read the highlights of the deficit-reduction proposals. The include the following:-Overhaul individual income taxes and corporate taxes. For individuals and families, eliminate a host of popular tax credits and deductions,...

-

Unemployment rate down because people quit looking for work. Stupid fucking numbers games The unemployment rate dropped to 9.5 percent for the month of June even as the U.S. government dropped 225,000 Census jobs, the Labor Department reported Friday...