"the number of Americans who think the economy is getting worse has jumped 13 percentage points in just one month"

Now, the NYT tries to explain a bit, and then winds (naturally) to some justifications, apologia, and excuses.

Obama ACTUALLY CONTINUES TO BLAME OTHERS (GWB, if you can imagine so immature a person after 2-3 years as president).

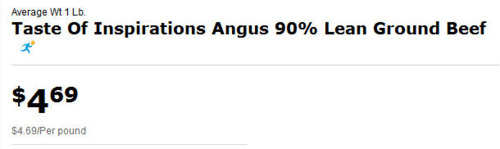

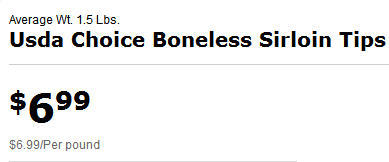

Let me explain the ‘problem’ of our depressing days … IN ADDITION to the unstable employment situation, in addition to the clear lack of energy policies (WHICH ARE REALISTIC), in addition to the wars, in addition to the failed effects of the govt giveaways to HUGE CORP’s that are stupid, venal and greedy, and feel entitled, in addition to the RIDICULOUS assertion that because Wall Street, Goldman Sachs, and GE are up, it's all getting better, we have in the last weeks seen WITH OUR OWN FRICKIN' EYES -THIS:

which means we are appalled at trying to eat (somewhat) healthy and get around

and we start looking at and thinking about what we will be eating in a anouther year of this…

We are afraid we will not be able to afford the things we could afford LAST YEAR WHEN THINGS SUCKED ANYWAY BECAUSE, MR. OBAMA, THE TRACK YOU PUT US ON, ON YOUR OWN, SUCKS WAY MORE.

SO WE ARE DEPRESSED, NYT.. because this is out of our control until 2012, at which time the best we can do is get rid of Obama in favor of an admin which will GET OUT OF THE WAY, and then we cross our fingers it won’t take 10 years for the USA to heal itself on its own.

Or maybe, we SHOULD hope it only takes 10 years.

Barack Obama, J CARTER ON CRACK

PS:

McDonald’s Corp (NYSE:MCD - News) forecast higher prices for beef, dairy and other items and said it would cautiously raise prices to keep attracting diners, who are grappling with higher grocery and gas bills.

Shares fell 1.5 percent after the world’s biggest hamburger chain said it planned to offset some, but not all, of its higher food costs, with small price increases throughout the year.

Gold hits record for fifth session, dollar tumbles

NEW YORK (Reuters) – Gold prices rallied to record highs on Thursday for a fifth straight session and silver surged as the dollar index tumbled for a third day toward an all-time low, prompting investors to buy bullion as a currency hedge.

Bullion, which jumped above $1,500 an ounce for the first time on Wednesday, once again rose in tandem with riskier assets such as equities on inflation fears.

“The U.S. dollar is in the midst of a severe downtrend. So the dollar is not the safe haven in view of the difficulty the U.S. government is having in resolving its budget deficit, and gold is benefiting from that,” said Leo Larkin, metals equity analyst at Standard & Poor’s.

Oil rises as dollar weakens

Oil higher on weaker dollar, gas pump average price at $3.84 a gallon

Oil rose on Thursday, as the dollar weakened and gas pump prices inched higher.

Benchmark West Texas Intermediate crude added 84 cents to settle at $112.29 per barrel on the New York Mercantile Exchange. In London, Brent crude rose 14 cents to settle at $123.99 per barrel.

At one point on Thursday the dollar dropped to a 16-month low against the euro. Since oil is priced in dollars, it becomes more attractive to buyers holding foreign currency as the dollar gets weaker. The dollar’s been falling as investors remain convinced the Federal Reserve will keep interest rates near zero. Lower rates make the dollar less attractive.

- Hey 53%, Happy Yet?

Oil slips as dollar gains, gasoline up for 34th straight day to $3.86 per gallonNEW YORK, N.Y. - The price of crude oil was stable Monday, dipping one cent to settle at US$112.28 per barrel on the New York Mercantile Exchange as the U.S. dollar pulled...

-

Yahoo/AP: Wholesale prices up 1.6 pct. on steep rise in food Wholesale prices rise 1.6 pct. due to biggest jump in food costs in more than 36 years On Wednesday March 16, 2011, 8:57 am EDT WASHINGTON (AP) -- Wholesale prices jumped last month by the most...

- Oil:fundamentally, There Is Little Reason For The Recent Price Spikes

The economy shows only manipulated numbers of some kind of hope for the end of the year for those who emotionally or politically cannot bear the realities of mild deflation (checked those LCD screen prices lately ?) . Prices on homes, appliances,...

- Another Day And Even More Of The Same... What's It Going To Take, Americans?

NO one should doubt the veracity and completeness of this amoral judgement on the character of of us as a people and our government. Those whose job it is to preserve and increase wealth, have no confidence in the american people, their fortitude,...

- What On Earth Is It Going To Take? Why Are All Leaders Silent?

Oil Briefly Tops $103 a Barrel for 1st Time As US Dollar Weakness Draws Investors Oil prices briefly surpassed $103 a barrel for the first time Friday as persistent weakness in the U.S. dollar and the prospect of lower interest rates attracted...