Green Energy

From Judicial Watch:

- Irs Finds Yet Another Lois Lerner Email Account, Alias "toby Miles"

From the Washington Times: Lois Lerner had yet another personal email account used to conduct some IRS business, the tax agency confirmed in a new court filing late Monday that further complicates the administration’s efforts to be transparent about...

- Fed Judge Issues Emergency Order Blocking Cheryl Mills From Deleting Emails

I Got The Right To Erase Whatever I Want DailyCaller: Fed Judge issues emergency order blocking Cheryl MILLS from deleting emails A federal judge has intervened to block Cheryl Mills, Hillary Clinton’s chief of staff at the State Department, from deleting...

- Irs Admits They Have Not Searched For Lois Lerner’s Missing Emails

The Audacity of Hope From Judicial Watch: Judicial Watch announced today that the Internal Revenue Service (IRS) admitted to the court that it failed to search any of the IRS standard computer systems for the “missing” emails of Lois Lerner and other...

- Second Federal Judge Orders Irs To Explain “lost” Lerner Emails Under Oath

From Fox News: A second federal judge has now ordered the IRS to explain under oath how the agency lost emails from former division director Lois Lerner, the woman at the heart of the Tea Party targeting scandal. U.S. District Court Judge Reggie...

- Federal Judge Orders Irs To Have An Official Explain Lost Lois Lerner Emails “under Oath”

From Fox News: A federal judge has ordered the IRS to explain “under oath” how the agency lost a trove of emails from the official at the heart of the Tea Party targeting scandal. U.S. District Judge Emmet G. Sullivan gave the tax agency 30...

Green Energy

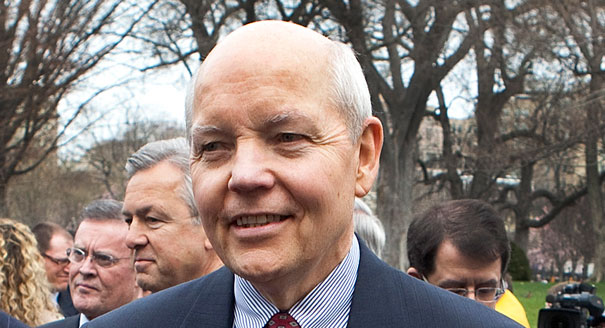

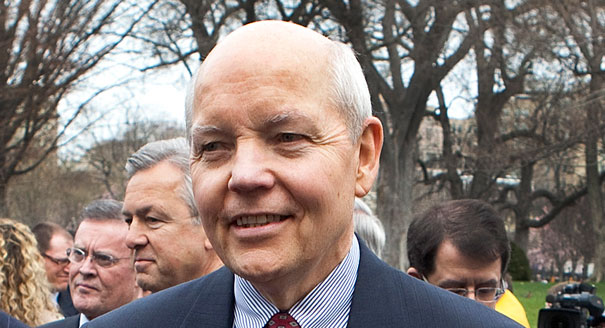

BREAKING NEWS: Federal Judge Threatens To Hold IRS Commissioner, DOJ Lawyers in Contempt of Court over Lerner

IRS Commissioner, John Koksukaman

From Judicial Watch:

(Washington, DC) – Judicial Watch announced that U.S District Court Judge Emmet Sullivan today threatened to hold the Commissioner of the Internal Revenue Service and Justice Department attorneys in contempt of court after the IRS failed to produce status reports and newly recovered emails of Lois Lerner, former director of the Exempt Organizations Unit of the IRS, as he had ordered on July 1, 2015.

During the a status hearing today, Sullivan warned that the failure to follow his order was serious and the IRS and Justice Department’s excuses for not following his July 1 order were “indefensible, ridiculous, and absurd.” He asked the IRS’ Justice Department lawyer Geoffrey Klimas, “Why didn’t the IRS comply” with his court order and “why shouldn’t the Court hold the Commissioner of the IRS in contempt.”

Judge Sullivan referenced his contempt findings against Justice Department prosecutors in the prosecution of late Senator Ted Stevens (R-AK) and reminded the Justice Department attorney he had the ability to detain him for contempt. Warning he would tolerate no further disregard of his orders, Judge Sullivan said, “I will haul into court the IRS Commissioner to hold him personally into contempt.”

After the hearing, Judge Sullivan issued the following “minute order”:

At the July 29, 2015 status hearing, the Government agreed that the Court’s July 1, 2015 oral order from the bench was clear and enforceable. Nonetheless, the Government reasoned it inappropriate to file a motion for reconsideration until a written order was issued. As expressed at the hearing, the Government’s reasoning is nonsensical. Officers of the Court who fail to comply with Court orders will be held in contempt. Also, in the event of non-compliance with future Court orders, the Commissioner of the IRS and others shall be directed to show cause as to why they should not be held in contempt of Court. The Court’s July 1, 2015 ruling from the bench stands: (1) the Government shall produce relevant documents every Monday; (2) the Government’s document production shall be accompanied by a status report that indicates (a) whether TIGTA has turned over any new documents to the IRS, (b) if so, the number of documents, and (c) a timeframe for the IRSs production of those documents. Signed by Judge Emmet G. Sullivan on July 29, 2015.

- Irs Finds Yet Another Lois Lerner Email Account, Alias "toby Miles"

From the Washington Times: Lois Lerner had yet another personal email account used to conduct some IRS business, the tax agency confirmed in a new court filing late Monday that further complicates the administration’s efforts to be transparent about...

- Fed Judge Issues Emergency Order Blocking Cheryl Mills From Deleting Emails

I Got The Right To Erase Whatever I Want DailyCaller: Fed Judge issues emergency order blocking Cheryl MILLS from deleting emails A federal judge has intervened to block Cheryl Mills, Hillary Clinton’s chief of staff at the State Department, from deleting...

- Irs Admits They Have Not Searched For Lois Lerner’s Missing Emails

The Audacity of Hope From Judicial Watch: Judicial Watch announced today that the Internal Revenue Service (IRS) admitted to the court that it failed to search any of the IRS standard computer systems for the “missing” emails of Lois Lerner and other...

- Second Federal Judge Orders Irs To Explain “lost” Lerner Emails Under Oath

From Fox News: A second federal judge has now ordered the IRS to explain under oath how the agency lost emails from former division director Lois Lerner, the woman at the heart of the Tea Party targeting scandal. U.S. District Court Judge Reggie...

- Federal Judge Orders Irs To Have An Official Explain Lost Lois Lerner Emails “under Oath”

From Fox News: A federal judge has ordered the IRS to explain “under oath” how the agency lost a trove of emails from the official at the heart of the Tea Party targeting scandal. U.S. District Judge Emmet G. Sullivan gave the tax agency 30...