Green Energy

The socialist chancellor of the exchequer of Great Britain, Gordon Brown, has announced that he would like to make Britain "the gateway to Islamic finance and trade". Sort of like an Islamic Mos Eisley :

It is rumoured that Mr Brown finished his speech with "Allahu Akbar, Death To Israel, Death To America, Death To The Non-Believers, Long Live The Khilafah etc...."

/ok, so I made that last line up ;)

- London Steps Up Islamic Finance Ambitions

Selling Them The Rope To Hang Us From Sailan Muslim: Britain is encouraging banks through a task force to establish sharia-compliant products, aiming to position London as a Western hub for a fast-growing Islamic finance sector that is expected to reach...

- Uk: Treasury Rewriting Britain's Tax Laws To Accommodate Sharia Financ

Maybe if I play dead the Muslims will leave me alone. From Jihad Watch: "Sharia Law Sneaked Into Labour Budget," by Kirsty Buchanan for the Sunday Express, December 13: THE Treasury plans to rewrite Britain's tax rules to usher...

- Gordon Brown Wants Uk To Be The International Financial Center For Sharia Products

After Dutch MP, Geert Wilders was declared "persona non grata" and deported from UK because his presence was threatening community harmony, I found that Times On Line published an article (which herroyalwhyness pointed out to me was written in March...

- Islamic Banking - Growth And Prospects

Check out this article from ABC Australia. It reads like a Press Release from the Saudis. From ABC Austalia: The Islamic banking industry is now worth almost an estimated US$1 trillion and is widely considered to be one of the fastest growing sectors...

- Uk Looks To Become A Global Provider Of Islamic Finance

From Mortgage Strategy: A government organisation is looking to educate financial institutions in a bid to help the UK become a global provider of Islamic finance. UK Trade & Investment, which incorporates the work of the Foreign & Commonwealth...

Green Energy

Gordon Brown Takes Next Step In Creation Of Britainistan

The socialist chancellor of the exchequer of Great Britain, Gordon Brown, has announced that he would like to make Britain "the gateway to Islamic finance and trade". Sort of like an Islamic Mos Eisley :

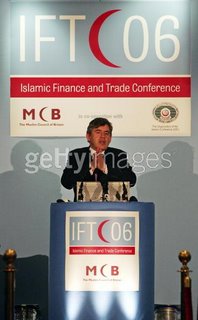

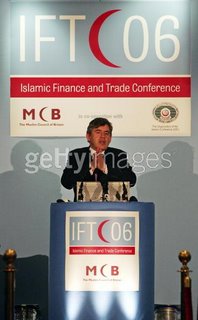

London, 13 June (AKI) - Britain's finance minister, Gordon Brown on Tuesday signalled he wants to make London a global centre for the rapidly expanding Islamic finance market - by offering a regulatory and tax environment that will support the creation of financial products for devout Muslims. Brown announced the move in a keynote speech to the Islamic Finance and Trade Conference in London, organised by the country's mainsteam Muslim grouping, the Muslim Council of Great Britain. The defining feature of the Islamic finance industry is that it offers products without interest payments to comply with the Koranic ban on usury.

It was a "realistic and realisable" ambition to make Britain "the gateway to Islamic finance and trade," Brown told the conference. His speech praised "the invaluable contribution of the whole of the Muslim community in Britain... to our prosperity, our society and our culture," and its "entrepreneurial vibrancy and dynamism." Muslims make an "enormous" contribution to the British economy, Brown said.

Islam is Britain's second largest faith and the country has one of the largest Muslim populations (upwards of 1.6 million) in Europe.

Brown's remarks came as investment banks based on the City of London are scrambling to capture a slice of a market estimated to be worth as much as 400 billion dollars worldwide and which is enjoying a a boom on the back of growing oil-wealth in the Middle East, heightened religious sentiment across the Muslim world, and the increasing use of Islamic compliant products such as bonds - sukuks - that are sold to investors globally to finance large banking projects in the Middle East.

"Already, Britain is the largest European trader with many Islamic countries - the largest European investor in Oman, the largest non-Arab investor in Egypt, and second largest global investor in Pakistan and Saudi Arabia," Brown noted.

Britain's trade with Arab countries has grown 60 per cent in the last five years, while at the same time its exports to Indonesia, Malaysia, Pakistan and Bangladesh grew to nearly 5.52 billion dollars in 2005 and to North Africa to over 1.84 billion dollars, Brown said.

"I, like you, would like Britain's strong economic ties with Muslim countries strengthen still further.. too often our relationship with the Muslim world is described through a prism of conflict and tension," he stated.

"Today British banks are pioneering Islamic banking - London now has more banks supplying services under Islamic principles than any other Western financial centre," Brown said.

Some in Britain hope that the growing involvement of British banks in the Islamic finance sector could provide a non-political platform for cooperation between the Muslim world and the West, according to unnamed officials quoted by Britain's Financial Times newspaper.

In conjunction with the Muslim Council of Great Britain, the government has already carried out tax and regulatory reform to support the development of finance that is compatible with Islamic (Sharia) law, Brown said. The Islamic mortage market grew almost 50 percent last year alone to more than 0.92 billion dollars, he pointed out.

The government has also provided comprehensive consumer protection for Islamic savings and borrowing (Ijara) products, Brown said. Last week, the parliament approved measures in the UK Finance Bill for diminishing musharaka (a form of leasing) and wakala (agency fees, for example on deposit accounts).

A growing number of London banks are involved in the Islamic bond (sukuk) market. "I am pleased that London was the financial centre chosen recently to advise on one of the largest sukuk deals ever done." The main banks invovled in this type of business include HSB, Citigroup, Barclays Capital, Deutsche Bank, BNP Paribas and Standard Chartered, according to the Financial Times.

London is perceived to be the main centre for Islamic investment banking activity outside the Muslim world. However, it will have to fight off competition from centres such as Dubai in the United Arab Emirates, which are scrambling to transform themselves into new financial hubs.

Other conference speakers included Khalfan Karbash, United Arab Emirates finance and industry minister; Ebrahim bin Khalifa Al Khalifa, Bahrain minister of finance; Ahmed Mohammed Ali, president of the Islamic Development Bank; and Hussain Ali Al-Abdullah, of the Qatar Investment Authority.

Link...

It is rumoured that Mr Brown finished his speech with "Allahu Akbar, Death To Israel, Death To America, Death To The Non-Believers, Long Live The Khilafah etc...."

/ok, so I made that last line up ;)

- London Steps Up Islamic Finance Ambitions

Selling Them The Rope To Hang Us From Sailan Muslim: Britain is encouraging banks through a task force to establish sharia-compliant products, aiming to position London as a Western hub for a fast-growing Islamic finance sector that is expected to reach...

- Uk: Treasury Rewriting Britain's Tax Laws To Accommodate Sharia Financ

Maybe if I play dead the Muslims will leave me alone. From Jihad Watch: "Sharia Law Sneaked Into Labour Budget," by Kirsty Buchanan for the Sunday Express, December 13: THE Treasury plans to rewrite Britain's tax rules to usher...

- Gordon Brown Wants Uk To Be The International Financial Center For Sharia Products

After Dutch MP, Geert Wilders was declared "persona non grata" and deported from UK because his presence was threatening community harmony, I found that Times On Line published an article (which herroyalwhyness pointed out to me was written in March...

- Islamic Banking - Growth And Prospects

Check out this article from ABC Australia. It reads like a Press Release from the Saudis. From ABC Austalia: The Islamic banking industry is now worth almost an estimated US$1 trillion and is widely considered to be one of the fastest growing sectors...

- Uk Looks To Become A Global Provider Of Islamic Finance

From Mortgage Strategy: A government organisation is looking to educate financial institutions in a bid to help the UK become a global provider of Islamic finance. UK Trade & Investment, which incorporates the work of the Foreign & Commonwealth...