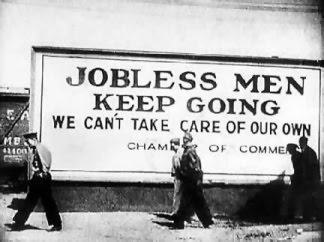

No Depression: Smoke & Mirrors & More BS from the BLS

Not too much time to talk about this today. Got another job fair to attend.

Believe what you like but suffice to say, when you add only 80,000 jobs last month AND the "official" unemployment rate drops to 9.0% it's a fair bet the drop isn't because people are getting back to work.

I've said this was coming.

The 99ers are stacking up.

Bloomberg:

U.S. Payrolls Rose in October; Jobless Rate 9%

The jobless rate unexpectedly fell in October while employers added fewer jobs than forecast, illustrating the “frustratingly slow” progress cited by Federal Reserve Chairman Ben S. Bernanke this week.

The unemployment rate fell to a six-month low of 9 percent from 9.1 percent, even as the labor force expanded. The 80,000 increase in payrolls followed gains in the prior two months that were revised up by 102,000, Labor Department figures showed today in Washington.

The crisis in Europe and a looming deadline on U.S. budget talks may be prompting companies to delay hiring on concern failure to reach resolutions will put the global recovery at risk. Fed policy makers project the jobless rate won’t drop below 8 percent until 2013 at the earliest, one reason why Bernanke this week said additional stimulus “remains on the table.”

“We’re making progress at a very slow pace,” said John Silvia, chief economist at Wells Fargo Securities LLC inCharlotte, North Carolina, who projected an 85,000 gain in payrolls. “It indicates continued consumer spending, getting a little better over time. The labor market is consistent with moderate economic growth.”

The data also showed a pickup in hourly earnings, a drop in long-term joblessness and a decrease in so-called under-employment.

Stock Futures

Stocks fell as concern about Europe offset the decline in the jobless rate. The Standard & Poor’s 500 Index slid 1.1 percent to 1,247.83 at 10:01 a.m. in New York. The yield on the benchmark 10-year Treasury note declined to 2.05 percent from 2.07 percent late yesterday.

The unemployment rate was forecast to hold at 9.1 percent, according to the median of 87 forecasts in a Bloomberg News survey of economists. Payrolls were forecast to rise by 95,000.

Sustained payroll increases of around 150,000 a month are needed to bring unemployment down about half a percentage point over a year, according to Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York.

Faster hiring would spur bigger gains in incomes and bolster confidence, helping cushion against declines in home prices and allowing households to sustain their spending. Purchases grew at a 2.4 percent annual rate in the third quarter and the economy expanded at a 2.5 percent pace, the Commerce Department reported last week.

Retailers like Macy’s Inc. (M) are adding staff, while companies such as Whirlpool Corp. (WHR) plan to cut workers, evidence of an uneven economic recovery.

Part-Time Employees

Macy’s is among those betting last quarter’s gain in spending will be sustained during the November-December holiday shopping season. The second-biggest U.S. department-store chain is stepping up hiring of mostly part-time employees by 4 percent for the period.

Whirlpool, the world’s largest maker of household appliances, said it planned to cut more than 5,000 jobs and trimmed its earnings forecast. The reductions will be primarily within North America and Europe and include the closure of the refrigeration manufacturing site in Fort Smith, Arkansas, by mid-2012.

“We are taking necessary actions to address a much more challenging global economic environment,” Chief Executive Officer Jeff Fettig said in a statement on Oct. 28.

Payroll Revisions

The payroll revisions for September and August put those numbers closer to the bigger gains in hiring seen in the separate survey of households. The latter showed a 277,000 gain in employment for October, raising the odds that last month’s payroll figures will also be revised higher.

“There seems to be a disconnect between the payrolls survey and the household survey, and we’ve been getting more on the household side in the last few months, enough to bring the unemployment rate down slightly,” said Robert Dye, chief economist at Comerica Inc. in Dallas.

Private hiring, which excludes government agencies, rose to 104,000 after a revised gain of 191,000. It was projected to rise by 125,000, the survey showed.

Factory payrolls increased by 5,000, the first increase in three months.

Employment at service-providers increased 90,000 after a 129,000 gain. Construction companies cut 20,000 jobs and retailers added 17,800 employees, the most in three months.

Government payrolls decreased by 24,000. State and local governments cut employment by 22,000, while the federal government trimmed 2,000 workers.

Hourly Earnings

Average hourly earnings rose 0.2 percent to $23.19, while hours worked held at 34.3 hours, today’s report showed.

The so-called underemployment rate -- which includes part-time workers who’d prefer a full-time position and people who want work but have given up looking -- decreased to 16.2 percent from 16.5 percent.

The report also showed a decrease in long-term unemployed Americans. The number of people unemployed for 27 weeks or more decreased as a percentage of all jobless, to 42.4 percent from 44.6 percent. It was last lower in November 2010.

The number of temporary workers increased 15,000. Payroll at temporary-help agencies often slow as companies seeing a steady increase in demand take on permanent staff.

Government Spending

Uncertainty over the amount and speed of reductions in government spending is weighing on businesses as the Nov. 23 deadline looms for the congressional supercommittee charged with cutting at least $1.2 trillion from the budget deficit. In the fiscal year ended Sept. 30, the government reported the second-highest annual deficit on record, $1.3 trillion.

Fed policy makers, who refrained from taking additional steps to ease monetary policy at their meeting this week, said in a statement that there are “significant downside risks to the economic outlook.”

The central bank’s latest forecasts showed less optimism about the economy and employment. Policy makers project growth next year of 2.5 percent to 2.9 percent, with unemployment in the 8.5 percent to 8.7 percent range. Joblessness in 2013 is forecast at 7.8 percent to 8.2 percent.

Additional stimulus “remains on the table,” Bernanke said at a Nov. 2 press conference in Washington, declining to specify conditions that would prompt a move. “While we still expect that economic activity and labor market conditions will improve gradually over time, the pace of progress is likely to be frustratingly slow.”

-

Bloomberg: Bernanke Says 8.3% Unemployment Understates Weakness in U.S. Labor Market By Craig Torres and Josh Zumbrun Federal Reserve Chairman Ben S. Bernanke said the 8.3 percent rate of unemployment in January understates weakness in the U.S. labor...

- Wreckovery!

Bloomberg: Initial U.S. Jobless Claims Rose More Than Forecast to 445,000 Last WeekBy Courtney Schlisserman - Jan 13, 2011 10:06 AM ET The number of first-time claims for unemployment insurance payments jumped in the first week of 2011 to the highest...

- Humbug Ii

Well, this info was seriously fucked up. MSNBC: Nation’s jobless rate jumps to a seven-month high U.S. employers added smaller-than-expected 39,000 jobs in November WASHINGTON — The nation’s unemployment rate climbed to 9.8 percent in November,...

- I Can't Stand It Anymore

having more & more of Epa's Howard Beale moments lately. . . PLEASE TELL ME HOW THE FUCK THEY CAN SPIN IT AS AN IMPROVEMENT IN THE JOBLESS RATE WHEN A PARAGRAPH EARLIER THEY SAID IT WAS BECAUSE PEOPLE GAVE UP LOOKING FOR WORK! newsmax: Unemployment...

- Breaking: Unemployment At 9.7% – New Counting Method Saved Or Created 541,000 Jobs

Remember this? Today at Gateway Pundit: US Loses Another 20,000 Jobs But Unemployment Rate Drops to 9.7% It’s an Obama world. Up is down. Square is round. Trucks are jokes. And, losing 20,000 jobs actually brings down the unemployment rate. The US...