Green Energy

There is what I would call a meme going around that states we are not required to sign up for Obamacare.

So yes, some people are not required to sign up.

- San Francisco Chronicle: Lowering Your 2014 Income Can Net You A Huge Healthcare Subsidy

Government-Subsidized Laziness The Hallmark of Socialism All the Honey Boo Boo Brain-frys who voted for Obama can be so proud of themselves. From the San Francisco Chronicle. People whose 2014 income will be a little too high to get subsidized...

- Obamacare Fail

Forget the hope of those high-risk pools for health insurance: Funds run low for health insurance in state ‘high-risk pools’ Tens of thousands of Americans who cannot get health insurance because of preexisting medical problems will be blocked from...

-

Muslims Exempt From ObamaCare Because it Violates Sharia Law? The Senate health care bill just signed contains some exemptions to the "pay-or-play" mandate requiring purchase of Obamacare-approved health insurance or payment of a penalty fine....

- Irs, Check.... Census, Check......

Gee, I wonder how this happened. Census Adds Question About Health Insurance I haven't paid much attention to the upcoming 2010 Census, until the recent death of part-time Census worker Bill Sparkman, whose death under unclear circumstances is being...

- Fascism You Had Better Believe In

It is appropriate that the Democrats in the Senate would spring their nationalized medicine scheme on America just before the Fourth of July. This AP story provides this interesting twist on how they intend to deal with recalcitrant serfs: WASHINGTON...

Green Energy

Not required to sign up for Obamacare?

There is what I would call a meme going around that states we are not required to sign up for Obamacare.

Before its news is one place that has it.

But according to Healthcare.gov, this cannot be true. It's called Individual Mandate:

If someone who can afford health insurance doesn’t have coverage in 2014, they may have to pay a fee. They also have to pay for all of their health care.

The fee is sometimes called the "individual responsibility payment," "individual mandate," or penalty.

When the uninsured need care

When someone without health coverage gets urgent—often expensive—medical care but doesn't pay the bill, everyone else ends up paying the price.

That's why the health care law requires all people who can afford it to take responsibility for their own health insurance by getting coverage or paying a fee.

People without health coverage who pay the penalty will also have to pay the entire cost of all their medical care. They won't be protected from the kind of very high medical bills that can sometimes lead to bankruptcy.

The penalty in 2014 and beyond

The penalty in 2014 is calculated one of 2 ways. You’ll pay whichever of these amounts is higher:

- 1% of your yearly household income. The maximum penalty is the national average yearly premium for a bronze plan.

- $95 per person for the year ($47.50 per child under 18). The maximum penalty per family using this method is $285.

The fee increases every year. In 2015 it’s 2% of income or $325 per person. In 2016 and later years it’s 2.5% of income or $695 per person. After that it is adjusted for inflation.

If you’re uninsured for just part of the year, 1/12 of the yearly penalty applies to each month you’re uninsured. If you’re uninsured for less than 3 months, you don’t have a make a payment.

Learn more about the individual responsibility payment from the Internal Revenue Service.

Enroll by March 31, 2014 and you won’t have to make the individual shared responsibility payment

If you enroll in a health insurance plan through the Marketplace by March 31, 2014, you won’t have to make the payment for any month before your coverage began.

For example, if you enroll in a Marketplace plan on March 31 your coverage begins on May 1. If you didn’t have coverage earlier in the year, you won’t have to pay a penalty for any of the previous months of 2014.

If you pay the penalty, you're not covered

It's important to remember that someone who pays the penalty doesn't have any health insurance coverage. They still will be responsible for 100% of the cost of their medical care.

After open enrollment ends on March 31, 2014, they won't be able to get health coverage through the Marketplace until the next annual enrollment period, unless they have aqualifying life event.

Minimum essential coverage

To avoid the fee you need insurance that qualifies as minimum essential coverage. If you're covered by any of the following in 2014, you're considered covered and don't have to pay a penalty:

- Any Marketplace plan, or any individual insurance plan you already have

- Any employer plan (including COBRA), with or without “grandfathered” status. This includes retiree plans

- Medicare

- Medicaid

- The Children's Health Insurance Program (CHIP)

- TRICARE (for current service members and military retirees, their families, and survivors)

- Veterans health care programs (including the Veterans Health Care Program, VA Civilian Health and Medical Program (CHAMPVA), and Spina Bifida Health Care Benefits Program)

- Peace Corps Volunteer plans

- Self-funded health coverage offered to students by universities for plan or policy years that begin on or before Dec. 31, 2014

Other plans may also qualify. Ask your health coverage provider.

What kinds of health insurance don't qualify as coverage?

Health plans that don't meet minimum essential coverage don't qualify as coverage in 2014. If you have only these types of coverage, you may have to pay the fee. Examples include:

- coverage only for vision care or dental care

- workers' compensation

- coverage only for a specific disease or condition

- plans that offer only discounts on medical services

Exemptions from the fee

Some people with limited incomes and other situations can get exemptions from the fee. Learn about exemptions from paying the fee.

But, these are the exemptions. So it is these people who are not required to sign up or pay the fee:

Exemptions from the payment

Under certain circumstances, you won’t have to make the individual responsibility payment. This is called an “exemption.”

You may qualify for an exemption if:

- You’re uninsured for less than 3 months of the year

- The lowest-priced coverage available to you would cost more than 8% of your household income

- You don’t have to file a tax return because your income is too low (Learn about the filing limit.)

- You’re a member of a federally recognized tribe or eligible for services through an Indian Health Services provider

- You’re a member of a recognized health care sharing ministry

- You’re a member of a recognized religious sect with religious objections to insurance, including Social Security and Medicare

- You’re incarcerated, and not awaiting the disposition of charges against you

- You’re not lawfully present in the U.S.

Hardship exemptions

If you have any of the circumstances below that affect your ability to purchase health insurance coverage, you may qualify for a “hardship” exemption:

- You were homeless.

- You were evicted in the past 6 months or were facing eviction or foreclosure.

- You received a shut-off notice from a utility company.

- You recently experienced domestic violence.

- You recently experienced the death of a close family member.

- You experienced a fire, flood, or other natural or human-caused disaster that caused substantial damage to your property.

- You filed for bankruptcy in the last 6 months.

- You had medical expenses you couldn’t pay in the last 24 months.

- You experienced unexpected increases in necessary expenses due to caring for an ill, disabled, or aging family member.

- You expect to claim a child as a tax dependent who’s been denied coverage in Medicaid and CHIP, and another person is required by court order to give medical support to the child. In this case, you do not have the pay the penalty for the child.

- As a result of an eligibility appeals decision, you’re eligible for enrollment in a qualified health plan (QHP) through the Marketplace, lower costs on your monthly premiums, or cost-sharing reductions for a time period when you weren’t enrolled in a QHP through the Marketplace.

- You were determined ineligible for Medicaid because your state didn’t expand eligibility for Medicaid under the Affordable Care Act.

- Your individual insurance plan was cancelled and you believe other Marketplace plans are unaffordable.

How to apply for an exemption

If you are applying for an exemption based on: coverage being unaffordable; membership in a health care sharing ministry; membership in a federally-recognized tribe; or being incarcerated:

You have two options--

- You can claim these exemptions when you fill out your 2014 federal tax return, which is due in April 2015

- You can apply for the exemptions using the appropriate form:

- Form to apply for exemption based on coverage being unaffordable (if you live in a state using Healthcare.gov)

- Form to apply for exemption based on coverage being unaffordable (if you live in a state using its own health exchange)

- Form to apply for exemption based on membership in a health care sharing ministry

- Form to apply for exemption for American Indians and Alaska Natives and others who are eligible for services from an Indian health care provider

- Form to apply for exemption based on being incarcerated

Note: If you get an exemption because coverage is unaffordable based on your expected income, you may also qualify to buy catastrophic coverage through the Marketplace. This may be more affordable than your other options.

If you’re applying for an exemption based on: membership in a recognized religious sect whose members object to insurance; eligibility for services through an Indian health care provider; or one of the hardships described above:

- You fill out an exemption application using the appropriate form:

- Form to apply for exemption based on membership in a recognized religious sect whose members object to insurance

- Form to apply for exemption based eligibility for services through an Indian health care provider

- Form to apply for exemption based on a hardship

If your income will be low enough that you will not be required to file taxes:

- You don’t need to apply for an exemption. This is true even if you file a return in order to get a refund of money withheld from your paycheck. You won’t have to make the shared responsibility payment.

If you have a gap in coverage of less than 3 months, or you are not lawfully present in the U.S.:

You don’t need to apply for an exemption. This will be handled when you file your taxes.So yes, some people are not required to sign up.

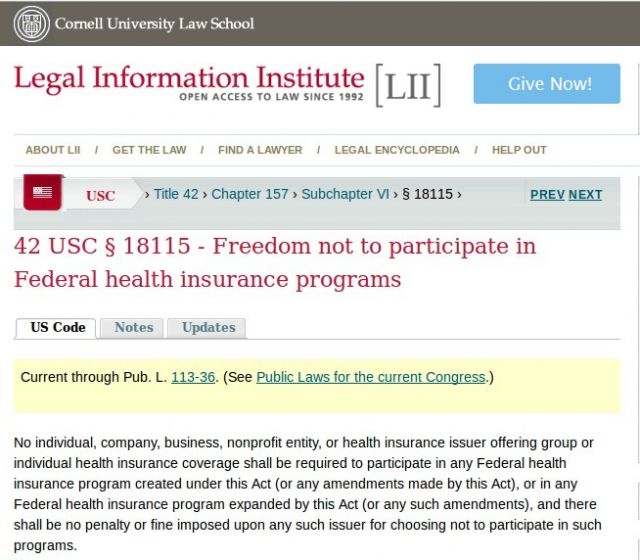

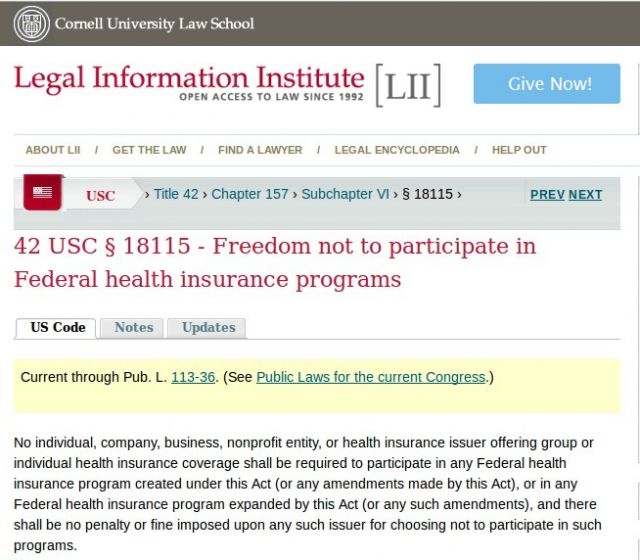

I believe 42 USC 18115 pertains to insurance providers. It is as confusing as the whole Obamacare fiasco.

- San Francisco Chronicle: Lowering Your 2014 Income Can Net You A Huge Healthcare Subsidy

Government-Subsidized Laziness The Hallmark of Socialism All the Honey Boo Boo Brain-frys who voted for Obama can be so proud of themselves. From the San Francisco Chronicle. People whose 2014 income will be a little too high to get subsidized...

- Obamacare Fail

Forget the hope of those high-risk pools for health insurance: Funds run low for health insurance in state ‘high-risk pools’ Tens of thousands of Americans who cannot get health insurance because of preexisting medical problems will be blocked from...

-

Muslims Exempt From ObamaCare Because it Violates Sharia Law? The Senate health care bill just signed contains some exemptions to the "pay-or-play" mandate requiring purchase of Obamacare-approved health insurance or payment of a penalty fine....

- Irs, Check.... Census, Check......

Gee, I wonder how this happened. Census Adds Question About Health Insurance I haven't paid much attention to the upcoming 2010 Census, until the recent death of part-time Census worker Bill Sparkman, whose death under unclear circumstances is being...

- Fascism You Had Better Believe In

It is appropriate that the Democrats in the Senate would spring their nationalized medicine scheme on America just before the Fourth of July. This AP story provides this interesting twist on how they intend to deal with recalcitrant serfs: WASHINGTON...