The deficit, the debt ALL OF IT, are related to loss of the job making machine,,, NEXT: Moody's-Student Loans-The Next Financial Bubble To Burst

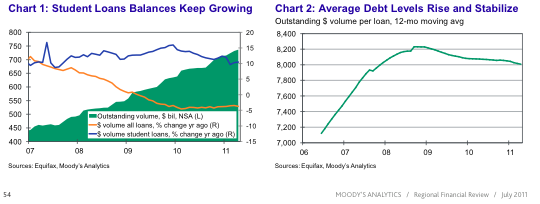

Record borrowing by college students who are graduating without jobs could lead to major problems in the nation’s economy, according to a recent report by Moody’s Analytics.

“The long-run outlook for student lending and borrowers remains worrisome,” concluded the report, which came out in July.

“Unlike other segments of the consumer credit economy, student loans have not demonstrated much improvement in performance despite some improvement in the broader economy. … [T]here is increasing concern that many students may be getting their loans for the wrong reasons, or that borrowers — and lenders — have unrealistic

If we do NOT identify the right moves to enhance employment, FIX Free Trade to be FAIR to all workers, and remove the govt burden from those who create employment to the maximum extent possible, there WILL BE INEVITABLY, people in the streets.

in addition to college enrollment tripling over the past four decades, “demand [for student loans] is driven by the cost of education, which has grown at an extraordinary rate over the past three decades.” Based on Consumer Price Index data, the cost of tuition and fees has more than doubled since 2000, and has outpaced inflation across all goods, health care, housing and energy.

The student loan debt load now outpaces credit card debt,

“Fears of a bubble in educational spending are not without merit,” the Moody’s report said.

For-profit schools, which have much lower graduation rates than traditional colleges, have also grown rapidly.

Youth unemployment among those under the age of 24 has been much higher than the rest of the workforce — creating an even more pessimistic outlook for student loan repayment. In the U.S., it was over 15 percent for the first quarter of 2011, and is similarly problematic around the world.

The 2008 financial crisis was brought about by a few incremental points in unemployment, which cascaded to a few incremental points in late mortgage payments.

If student debt outpaces credit card debt in the USA, what is lurking out there as a result of the evisceration of the American job making machine.

- Beware Of Those College Loans!

In all the uproar with the SCOTUS decision on ObamaCare, many interested and affected parties may have missed THIS: ...Starting Sunday [July 1], students hoping to earn the graduate degrees that have become mandatory for many white-collar jobs will become...

-

Hey, I burned through my retirement and severance and unemployment and ran the credit cards up to try and survive these last 3-1/2 years of Wreckovery. I understand the pain of the people in this story. But not the idea things may be turning around. MSNBC:...

-

HEY! Has anyone heard anything about the Superduper Committee lately? You know, that extra-constitutional gang of 12 Angry Men and Women who were supposed to cure all the nations economic woes by Thanksgiving. Have they met yet? Have they made any proposals...

-

Newsmax: Homes Lost to Foreclosure On Track for 1M in 2010 Thursday, 15 Jul 2010 07:32 AM More than 1 million American households are likely to lose their homes to foreclosure this year, as lenders work their way through a huge backlog of borrowers who...

- Banks Hoarding Cash, But There's A Bull Market Coming

From 3 Wood at Jammie Wearing Fool: With all the market unrest, and the year end reporting coming up soon, it appears that banks have resumed hoarding cash to make their balance sheet look better to investors.The cost of borrowing in dollars for one...