Green Energy

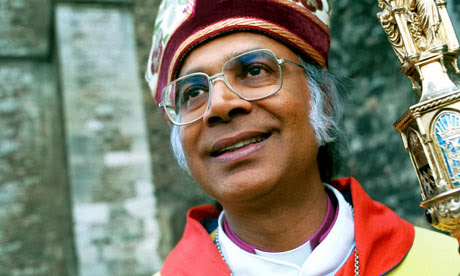

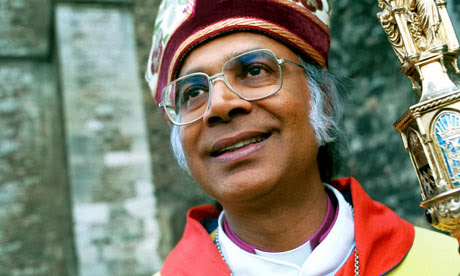

Michael Nazir-Ali is a great man. It's too bad the English people are not able to keep up with him.

From the Telegraph:

- Muslim Women Oppose Sharia Councils In Britain

from Arch-Bishop Cranmer h/y Her Royal Whyness Muslim women oppose Sharia councils in Britain Meet Dr Suhaib Hasan. He is one of the UK’s Sharia judges. He reminds us that Sharia means ‘the Islamic Law’ – ‘how to live according to the Muslim...

- Another Death Threat (uk)

This time, against the UK Bishop of Rochester, who spoke out about Muslim no-go areas in the UK. Not only are certain Muslims incensed. The Church of England doesn't approve of the bishop's stance, either. From this source on February 2, 2008:...

- One Bishop Who Knows About What He Is Talking - Christians Endangerd In Muslim Neighborhoods

The Telegraph informs us in a deserving article by Jonathan Wynne-Jones about "no-go zones for non-Muslims" in Britain. The Rt Rev Michael Nazir-Ali, the Bishop of Rochester and the Church's only Asian bishop, says that people of a different race...

- Senior Anglican Bishop Speaks Out Against Muslim Hypocrisy

Thanks to Religion of Pieces for sending this to us. From BBC News: A senior Anglican bishop has accused many Muslims of being guilty of double standards in their view of the world. The Bishop of Rochester, Michael Nazir-Ali, told the Sunday Times some...

- India Plans Several Green Bond Issues To Fund Renewable Energy Expansion

Article originally published in cleantechnica.com, on april 17th 2015India is looking at several avenues to finance its ambitious plans to expand renewable energy capacity. The Indian government has reportedly asked at least 8 financial institutions...

Green Energy

UK Bishop, Michael Nazir-Ali Warns UK's Issuance of Islamic Bonds Could Lead To More Sharia Law

Michael Nazir-Ali is a great man. It's too bad the English people are not able to keep up with him.

From the Telegraph:

David Cameron’s plans to issue sharia-compliant bonds open the way to Islamic law being enforced at the heart of government, a senior clergyman has warned.

Dr Michael Nazir-Ali, the former bishop of Rochester, said proposals to make Britain the first non-Muslim country to sell a bond that complies with sharia could trigger a series of “unforeseen consequences”.

He also voiced broader fears that Christianity was being increasingly excluded from the administration of law, after one of Britain’s most senior judges said members of the judiciary were “secular” figures serving a “multicultural community”.

Last week the Prime Minister set out plans for Britain to issue a sukuk, a form of debt that is in line with Islamic law, because it avoids the prohibited use of “riba”, or interest.

The bonds, which will be worth around £200 million, would pay a fixed return based on the profit generated by an underlying asset, such as government buildings.

However, Dr Nazir-Ali, who holds dual British and Pakistani citizenship, said of the plans: “This means that the Government itself will be subject to sharia in its dealings on these bonds.

“At the moment the issue is pretty modest, but how much will it grow? There’s a lot of liquidity out there and it could grow pretty rapidly, and then you may face a situation where a major part of your financial system is governed by sharia-compliant considerations.”

He added: “Before we take these steps that could have unforeseen consequences we do need greater public discussion, greater explanation of what actually is being done and what it is we are letting ourselves in for.”

The bishop said that a public debate on the introduction of the bonds should include whether sharia judges should be allowed to adjudicate in disputes over government-backed investments.

“They must be taking advice already from sharia scholars to put together these products. Has there been any discussion that such advice can be taken and that such adjudication can be acceptable in terms of official policy?”

- Muslim Women Oppose Sharia Councils In Britain

from Arch-Bishop Cranmer h/y Her Royal Whyness Muslim women oppose Sharia councils in Britain Meet Dr Suhaib Hasan. He is one of the UK’s Sharia judges. He reminds us that Sharia means ‘the Islamic Law’ – ‘how to live according to the Muslim...

- Another Death Threat (uk)

This time, against the UK Bishop of Rochester, who spoke out about Muslim no-go areas in the UK. Not only are certain Muslims incensed. The Church of England doesn't approve of the bishop's stance, either. From this source on February 2, 2008:...

- One Bishop Who Knows About What He Is Talking - Christians Endangerd In Muslim Neighborhoods

The Telegraph informs us in a deserving article by Jonathan Wynne-Jones about "no-go zones for non-Muslims" in Britain. The Rt Rev Michael Nazir-Ali, the Bishop of Rochester and the Church's only Asian bishop, says that people of a different race...

- Senior Anglican Bishop Speaks Out Against Muslim Hypocrisy

Thanks to Religion of Pieces for sending this to us. From BBC News: A senior Anglican bishop has accused many Muslims of being guilty of double standards in their view of the world. The Bishop of Rochester, Michael Nazir-Ali, told the Sunday Times some...

- India Plans Several Green Bond Issues To Fund Renewable Energy Expansion

Article originally published in cleantechnica.com, on april 17th 2015India is looking at several avenues to finance its ambitious plans to expand renewable energy capacity. The Indian government has reportedly asked at least 8 financial institutions...