Green Energy

Telegraph UK:

- Billion Dollar Babies

ALICE! Billion dollar babyRubber little lady, slicker than a weaselGrimy as an alleyLoves me like no other loverBillion dollar babyRubber little monster, baby, I adore youMan or woman living couldn't love me like you, babyWe go dancing nighty in...

-

Are you ready to get paid in Euros? Yen? British pounds? How about a whole new world currency? Businessweek: Central Banks Prepare to Distribute Foreign Currency at Home By Craig Torres Nov. 30 (Bloomberg) -- The Federal Reserve and five other central...

- Apoplectic: The Schizophrenic Cabinet, This Is A Good One ... Delusion Strikes

Euro strikes 16-month high against dollarThe euro struck a 16-month high against the dollar and the Swiss franc notched a record high versus the US unit Tuesday amid heightened investor nerves over this week’s busy economic calendar.The European single...

- Those Who Forget The Past..... Think Smoot Hawley Version 2.0

Brazil and China eye plan to axe dollarBy Jonathan Wheatley in São Paulo Published: May 18 2009 18:24 | Last updated: May 18 2009 23:31Brazil and China will work towards using their own currencies in trade transactions rather than the US dollar, according...

- The Politics Of Capital. Merciless. Force Of Nature. Amoral. Always Right

Fears of dollar collapse as Saudis take fright Saudi Plans to Keep Riyal Pegged to the Dollar, Adviser Says Canada's Dollar Nears Parity on U.S. Weakness, Commodity Surge China threatens 'nuclear option' of dollar sales Oil prices jump above...

Green Energy

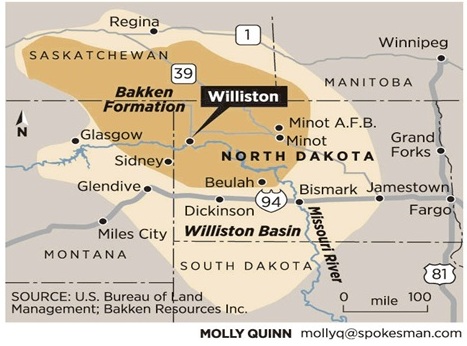

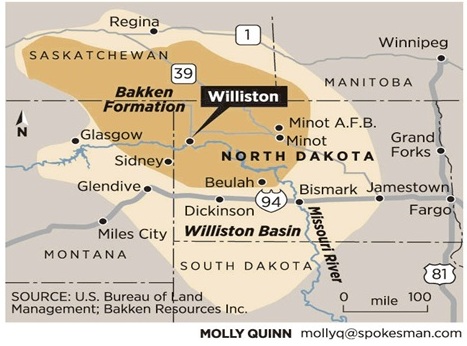

When you drill, baby, drill ….

Telegraph UK:

Dollar smashes through resistance as mega-rally gathers pace

HSBC says we are at the early stages of a dollar bull run that will change the world

The US dollar has surged to a four-year high against a basket of currencies and has punched through key technical resistance, marking a crucial turning point for the global financial system.

The so-called dollar index, watched closely by traders, has finally broken above its 30-year downtrend line as the US economy powers ahead and the Federal Reserve prepares to tighten monetary policy.

The index - a mix of six major currencies – hit 87.4 on Monday, rising above the key level of 87. This reflects the plunge in the Japanese yen since the Bank of Japan launched a fresh round of quantitative easing last week.

Data from the Chicago Mercantile Exchange show that speculative dollar bets on the derivatives markets have reached a record high, with the most extended positions against the euro, the yen, the Australian dollar, Mexican peso, the Canadian dollar, the Swiss franc, sterling, and the New Zealand dollar, in that order. The Swedish and Norwegian currencies are also coming under heavy pressure.

David Bloom, currency chief at HSBC, said a “seismic change” is under way and may lead to a 20pc surge in the dollar over a 12-month span. The mega-rally of 1980 to 1985 as the Volcker Fed tightened the screws saw a 90pc rise before the leading powers intervened at the Plaza Accord to cap the rise

Note that this is all achieved on the back of a SINGLE industry, free of any govt programs, and POSITIVE attention (in fact NEGATIVE) attention and given the War on Coal, in SPITE of the ruling admin.

WOW.

WOW.

- Billion Dollar Babies

ALICE! Billion dollar babyRubber little lady, slicker than a weaselGrimy as an alleyLoves me like no other loverBillion dollar babyRubber little monster, baby, I adore youMan or woman living couldn't love me like you, babyWe go dancing nighty in...

-

Are you ready to get paid in Euros? Yen? British pounds? How about a whole new world currency? Businessweek: Central Banks Prepare to Distribute Foreign Currency at Home By Craig Torres Nov. 30 (Bloomberg) -- The Federal Reserve and five other central...

- Apoplectic: The Schizophrenic Cabinet, This Is A Good One ... Delusion Strikes

Euro strikes 16-month high against dollarThe euro struck a 16-month high against the dollar and the Swiss franc notched a record high versus the US unit Tuesday amid heightened investor nerves over this week’s busy economic calendar.The European single...

- Those Who Forget The Past..... Think Smoot Hawley Version 2.0

Brazil and China eye plan to axe dollarBy Jonathan Wheatley in São Paulo Published: May 18 2009 18:24 | Last updated: May 18 2009 23:31Brazil and China will work towards using their own currencies in trade transactions rather than the US dollar, according...

- The Politics Of Capital. Merciless. Force Of Nature. Amoral. Always Right

Fears of dollar collapse as Saudis take fright Saudi Plans to Keep Riyal Pegged to the Dollar, Adviser Says Canada's Dollar Nears Parity on U.S. Weakness, Commodity Surge China threatens 'nuclear option' of dollar sales Oil prices jump above...