In case you wondered, they are just as dumb, but their mistakes are kinda sorta BIGGER

So, you read the Consumer Reports, and the Newegg Customer reviews, and you felt confident and bought that $450 LED/LCD and the picture sucks.

You due diligence effort was commensurate in time with the risk you took

So after Lehman croaked (was allowed to croak), banks AROUND THE WORLD changed their rules on how much liquid assets they kept around, and regulators insisted that these ZERO risk assets be increased. TARP and STIM I funneled huge amounts of FEDPRINTSCRIPT into them here and overseas, and not too much came back out.

Now, however, we find out courtesy of CNBC just what these assets are which a ZERO RISK LIQUID (I always thought this meant CASH or GOLD-DIAMONDS at worst)…NOPE…

GREEK BONDS?

GREEK BONDS?

YUP.

Western nation govt bonds were considered ZERO RISK LIQUID ASSET reserves for banks like Goldman-Sachs, BofA, Credit Suisee, Agricole, and Deutsche Bankes, etc

When regulators drew up the Basel I capital adequacy framework in the 1980s, for example, they gave western sovereign bonds a “zero” risk weighting, in terms of how capital is calculated. This was subsequently modified in Basel II, to give banks some theoretical discretion to raise reserves against sovereign risk. In practice, this zero-risk weighting policy has prevailed. In some senses it has been actually reinforced in the past five years because regulators have demanded that banks raise their holdings of liquid, safe assets, following that subprime turmoil. Those “safe” assets have been – you guessed it – mostly government bonds.

The settlement is that the non-default default will loan more money to nations like Greece so they can pay $.50 on the dollar, for the loans they already have including the principle value

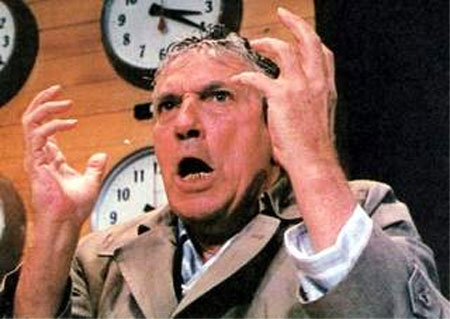

Can’t anyone learn anything?

Only cash is zero risk.

DUH. You didn’t loan the frickin money out anyway, so where is the cash? Greek Bonds? More leverage?

- Eminent Sense About Tbtf..it Sux

WSJ:Tom Frost: The Big Danger With Big BanksTaxpayer safety nets such as the FDIC should be available only to banks that are in the loan business, not those in the investment business.Once upon a time, banks which took deposits from clients, also known...

- Us Credit Shrinks At Great Depression Rate Prompting Fears Of Double-dip Recession

Telegraph UK: Professor Tim Congdon from International Monetary Research said US bank loans have fallen at an annual pace of almost 14pc in the three months to August (from $7,147bn to $6,886bn). "There has been nothing like this in the USA since...

- Banks Retreating From Partnership With Obama Administration

From Ed Morrissey at Hot Air: And after seeing what happened to executives at AIG and other TARP recipients, no one needs to ask why — except apparently for the Washington Post. Thanks to rapid infusions of cash, banks can now take their time unloading...

- And Bush Begat Rumsfeld Who Begat Frank, And He Begat Brownie, And Then He Begat Paulson

Tell me is it that no one knows what to do? No one understands how everything fits together? Or is it THESE GUYS who are basically clueless? Sorry, really didn;t mean to acquire toxic banks assets with that 3/4 of a trillion I was talking...

- Non-muslims Turn To Islamic Bank As A Safe Option

THE BIRMINGHAM POST: Growing numbers of non-Muslims are turning to Islamic banking as customers spooked by turmoil in the Western banking system increasingly see the sector as a safe haven. The Birmingham-headquartered Islamic Bank of Britain said it...